Is it allowed to trade stocks in Islam?

Islamic finance is rooted in Shariah, the body of Islamic law derived from the Quran and Hadith (sayings and actions of Prophet Muhammad, peace be upon him). It operates on principles of fairness, ethical conduct, and avoidance of activities considered haram (forbidden) in Islam. This framework extends to stock trading and share market investments.

Is Stock trading in Share Market Halal or Haram? The permissibility of trading in the stock market has long been a subject of debate among scholars in the Islamic community. While some argue that it is compatible with Islamic principles, others voice concerns about potential violations of Shariah. In this article, we delve into the opinions of senior and reputable Ulama, particularly focusing on the views of Mufti Taqi Uthmani Sahib Hafizahullah, who has offered guidelines on this matter.

The concept of share market and stock trading in Islam is a topic that has garnered significant attention and debate among scholars and Muslims worldwide. As financial markets continue to evolve, understanding the rules and principles that govern stock trading in Islam is crucial for those seeking to invest while adhering to their religious beliefs.

Mufti Taqi Uthmani Sahib Hafizahullah, a respected Islamic scholar, has outlined specific conditions under which trading in the stock market can be deemed permissible:

stock trading in Islam: Condition of trading in Share Market to be halal:

1. Shariah-Compliant Businesses

The primary business activities of the company whose shares are being traded must be in conformity with Shariah principles. This means that companies involved in activities such as usury (Riba), gambling (Maisir), alcohol, pork, or other haram activities should be avoided. Financial institutions that operate on interest-based models, like conventional banks, and insurance companies fall into this category.

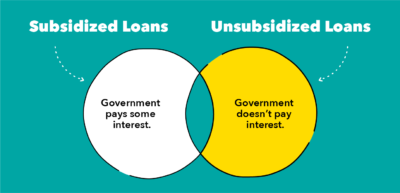

2. Avoidance of Riba

Riba, or usury, is strictly prohibited in Islam. Hence, investments in companies that engage in interest-based transactions or borrow money on interest should be avoided. Shareholders should express their disapproval of such dealings, ideally during the annual general meeting of the company.

3. Charity for Interest Income

If a company derives income from interest-bearing accounts, a portion of that income should be allocated to charitable causes, and it should not be retained by shareholders. This ensures that gains from forbidden sources are used for the betterment of society.

4. Non-Liquid Assets

Ownership of shares in a company is permissible only when the company possesses tangible non-liquid assets. In cases where a company’s assets consist entirely of liquid funds, typically in the form of money, shares can only be traded at their nominal par value. This is because, under such circumstances, shares essentially represent monetary assets and cannot be traded at values other than par..

5. Delivery of Stock

In stock trading, it is essential to ensure the physical delivery of the stock before selling it to another buyer. Selling shares without possessing them is not permitted.

6. Condemning Unlawful Practices:

In cases where companies engaged in halal businesses, such as automobiles or textiles, choose to deposit surplus funds in interest-bearing accounts or engage in interest-based borrowing, shareholders bear the responsibility of expressing their disapproval. This dissent should ideally take place within the context of the company’s annual general meeting, where shareholders can voice their concerns regarding such financial activities.

According to Mufti Taqi Uthmani Sahib Hafizahullah’s guidelines, investing in the stock market can be deemed permissible if the specified conditions are met. However, it is crucial for individuals to assess each investment opportunity carefully and ensure compliance with Islamic principles.

It is important to note that differences of opinion among scholars on this issue create a certain level of flexibility. Therefore, whether or not to invest in the stock market ultimately depends on an individual’s interpretation and adherence to their personal beliefs. Abstaining from stock market investments can also be seen as an act of Taqwa, reflecting a commitment to righteousness and piety.

For further insights into this topic and specific queries related to Islamic finance, it is advisable to seek guidance from qualified Islamic scholars who can provide personalized advice in accordance with one’s circumstances and beliefs.

Is stock trading in the share market halal or haram?

Stock trading in the share market can be deemed halal or haram depending on individual circumstances. As financial markets continue to evolve, understanding the rules and principles that govern stock trading in Islam is crucial for those seeking to invest while adhering to their religious beliefs. According to Islamic finance scholars, stock trading is permissible as long as it adheres to certain guidelines such as avoiding companies involved in prohibited activities (e.g., alcohol, gambling, pork) and ensuring compliance with Islamic financial principles (e.g., no interest-based transactions). It is recommended for Muslims to seek advice from knowledgeable scholars or financial experts to ensure compliance with their beliefs.

What are the key considerations when determining whether stock trading is halal or haram?

When evaluating the permissibility of stock trading in Islamic finance, there are several important factors to consider. Firstly, the underlying business activities of the company in which one intends to invest must be in line with Islamic principles. Secondly, the financial ratios and structures of the company should not involve interest-based transactions or excessive debt. Additionally, the shareholder rights and corporate governance practices should align with Islamic ethical standards. It is crucial to consult experts or scholars in Islamic finance to obtain a thorough understanding of these considerations.

Are there any alternatives for Muslims who wish to invest in the stock market while adhering to Islamic principles?

Yes, there are alternatives available for Muslims who want to invest in the stock market while complying with Islamic principles. One such option is investing in Sharia-compliant funds or Islamic investment portfolios, which are designed to comply with Islamic finance guidelines. These investment vehicles typically focus on companies that operate in permissible industries and follow Islamic financial principles. Additionally, some financial institutions offer Islamic banking services, including investment accounts that are structured to be Sharia-compliant. Consulting with Islamic financial advisors can help individuals find suitable alternatives for investing in the stock market while respecting their religious beliefs.

Follow us in Facebook for more recent updates

Discover more from Islam Hashtag

Subscribe to get the latest posts sent to your email.