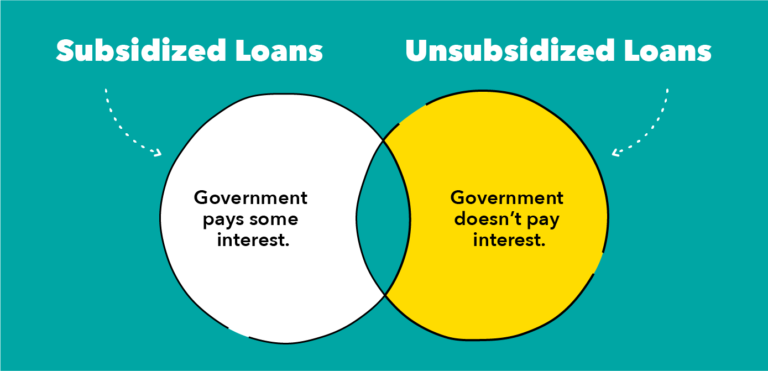

Is subsidized student loan permissible When applying for financial aid, the government offer grants and loans. There’s…

Halal Jobs for Muslims in North America-Halal Job Market Trends With a growing Muslim population in North…

Types of Bay Gharar in Islamic Finance Gharar is an Arabic term that refers to uncertainty, ambiguity,…

How to find Islamic finance jobs USA Islamic finance is a form of financial system that is…

Challenges For Islamic Banking The Islamic finance industry continues to attract new players and evolve its products…

Latest trend in the Islamic Fintech Industry What is Islamic Fintech? Islamic Fintech is a rapidly growing…

UK’s Al Rayan Bank fined $4.9 million fine for failing to adequately monitor the source of its…

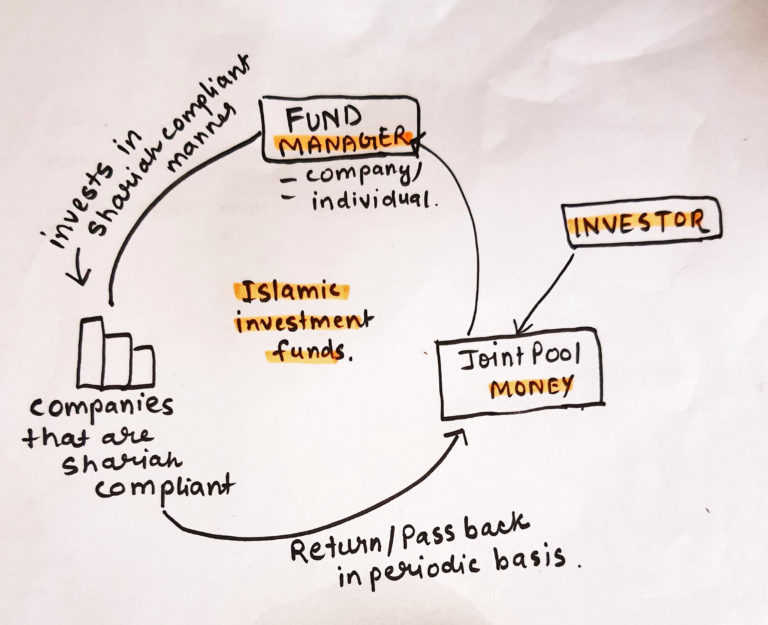

Islamic Investment Funds in Islamic shariah investment Islamic Investment funds have gained popularity over the years, especially…

What is murabaha in banking? Murabaha in other words is Cost-Plus Financing.This is a contract sale between…

Book on Islamic Finance: In my view, the first book you must read when you want to…

10 Best Books on Islamic banking and Islamic finance(Review) The benefits and wisdom of Islam and in…

The term khiyar refers to the option or right of the buyer & seller to rescind a…

10 Best Books on Islamic banking and Islamic finance(Review) The benefits and wisdoms of Islam and in…