Shariah loans in Australia

It is important to work with those who share your values. This belief works for everything from business to your personal life, and especially for financial matters.

Shariah-compliant finance – also known as Islamic banking or Islamic finance, refers to financial activities that observe and follow Shariah (Islamic law). Two fundamental principles of Islamic banking are sharing profit and loss and prohibiting the collection and payment of interest by lenders and investors.

History of Shariah-Compliant Finance

Scholars typically trace the practices of Shariah-compliant finance back to medieval-era Middle Eastern businesspeople who began engaging in financial transactions with their European contemporaries. While they initially adopted the same economic principles as the Europeans, numerous subsequent societal changes prompted a shift in financial practices.

Therefore, as trading systems developed over time and European countries began launching local branches of their financial institutions in the Middle East, some of these banks adopted the local customs of the region where they were newly established. These customs primarily included no-interest financial systems that operated on a profit-and-loss sharing method. Adopting these practices allowed the European banks to serve the needs of local Muslim businesspeople.

Shariah Loans in Australia

How Does Islamic Banking Work?

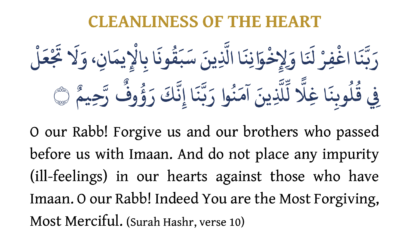

Islamic banking is grounded in the Islamic faith doctrines relating to commercial transactions. The laws of Islamic Finance are taken from the Quran–the central religious text of Islam. Therefore, in Islamic banking, all transactions must abide by Shariah (Islam’s legal code based on the teachings of the Quran). Additionally, rules governing commercial transactions in Islamic banking are known as fiqh al-muamalat.

One of the key differences between conventional and Islamic banking systems is that the former prohibits speculation and usury (the practice of charging excessive or illegally high-interest rates on a loan). Furthermore, Shariah strictly prohibits any form of gambling speculation (maisir). Any investments involving substances that the Quran prohibits—including alcohol, pork and gambling—are also disallowed. These strictures can make Shariah-compliant banking a culturally distinct type of ethical investing.

Institutions Offering Shariah Loans in Australia

If you want to source a loan from an Australian Shariah-compliant finance institution, here are some examples that may serve you well:

Ijarah Finance

The term Ijarah is an Arabic term meaning “lease”. When referencing property finance, Ijarah refers to the procedure through which a financier and client enter a contract together. This agreement enables the client to purchase a property, commercial asset or vehicle in compliance with Islamic Law.

Ijarah Finance’s operating principle is Rent-To-Own – A Lease Agreement giving you the option to own a leased asset once the lease period ends. In an Ijarah agreement, each party signs an agreed contract (known as an Ijarah contract or letter of offer) that protects both parties rights. This contract conforms with the National Consumer Credit Protection Act 2009 (NCCP).

Islamic Co-operative Finance Australia (ICFAL)

ICFAL was founded in 1998 to provide Australian Muslims with the support to live interest-free lives (Riba). Consequently, the bank has grown from its early days as a volunteer-driven provider. Its current status is as a leading Islamic Finance institution providing Shariah-compliant finance for housing, community infrastructure and vehicles.

MCCA

MCCA offers various Shariah-compliant finance products to meet varying needs. The institution has been fully accredited to provide Shariah-compliant property finance for over 30 years.

MCCA prides itself on being a one-stop property finance provider by ensuring your assignment to one staff member who guides you through the entire process, from application to discharge.

Hejaz Financial Services

Hejaz Financial Services was primarily established to provide every Muslim with Islamically permissible financial products and services without compromising integrity.

The company aims to create an intergenerational and sustainable Islamic financial ecosystem to cater to the Muslim community’s social, financial and economic needs.

Islamic Bank Australia

This institution’s mission is to transform Australian banking into a socially responsible enterprise that embraces the digital age while offering Australian Muslims valuable inclusion and choice.

However, please note that Islamic Bank Australia is not yet open for business. Instead, they are currently a “Restricted ADI” – a classification that allows them to build their systems and test their products before 5 July 2024. They then plan to obtain APRA approval to launch publicly. But you can now join their waiting list.

As you prepare to apply for a loan, look no further than these Shariah-compliant Australian financial institutions to ensure you obtain only those financial services and products that match your values while offering superior benefits.

Discover more from Islam Hashtag

Subscribe to get the latest posts sent to your email.