Saudi Arabia to Issue Sharia-Compliant Bonds worth billions

Saudi Arabia intends to release substantial sukuk, or Islamic law-compliant bonds, with the aim of enhancing the domestic market.

The National Debt Management Center (NDMC) recently revealed that Saudi Arabia has repurchased $9.52 billion worth of debt, encompassing debt instruments set to mature in 2024, 2025, and 2026.

In line with the Local Saudi Sukuk Issuance Program, Saudi Arabia’s government is gearing up to introduce sukuk valued at $9.57 billion, as reported by Bloomberg.

Saudi Arabia to Issue Sharia-Compliant Bonds worth billions

The Shariah Bond Program will encompass four segments, with maturity dates falling in 2031, 2032, 2033, and 2038.

The move is part of the National Debt Management Center’s plan to boost the domestic market.

The transaction will also align NDMC’s efforts with other initiatives to enhance public finances in the medium and long term.

HSBC Saudi Arabia, Al Rajhi Capital, SNB Capital, and AlJazira Capital have been appointed as joint lead managers to lead the transaction,

How much debt does Saudi Arabia have in sukuk?

Saudi Arabia has completed an early purchase of more than 35.7 billion riyals ($9.5 billion) of outstanding debt and will issue about 35.9 billion riyals in sukuk as the kingdom plans to bolster its domestic market.as reported by Bloomberg.

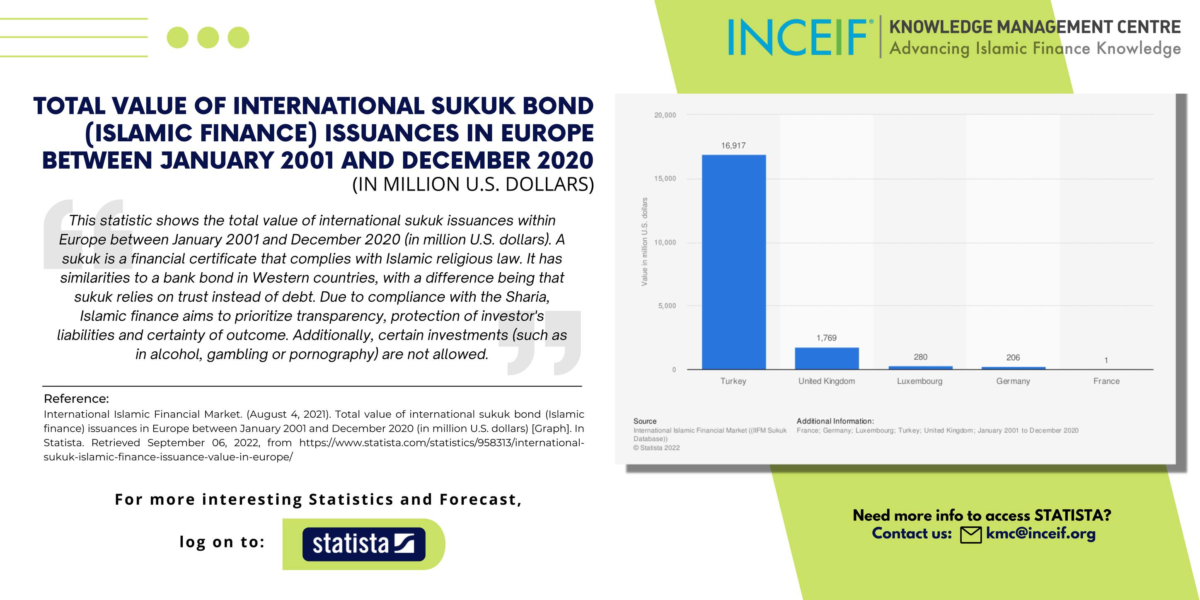

What is sukuk?

sukuk is a financial certificate that complies with Islamic religious law. It has similarities to a bank bond in Western countries, with a difference being that sukuk relies on trust instead of debt. Due to compliance with the Sharia, Islamic finance aims to prioritize transparency, protection of investor’s liabilities and certainty of outcome. Additionally, certain investments (such as in alcohol, gambling or pornography) are not allowed.

How is Sukuk different from bonds?

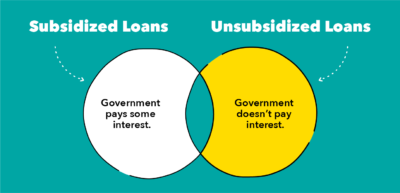

- Sukuk involves a direct asset ownership interest, while bonds are indirect interest-bearing debt obligations.

- Both sukuk and bonds provide investors with payment streams, however income derived from a sukuk cannot be speculative which would make it no longer halal.

Islamic Coin ($ISLM), the first Sharia-compliant cryptocurrency, set to launch in May 2023

Provided by news source

Discover more from Islam Hashtag

Subscribe to get the latest posts sent to your email.