Where to give zakat? Exploring the Eligible Recipients of Zakat

Zakat, a fundamental pillar of Islam, serves as a mechanism for wealth redistribution and social welfare. Central to Zakat’s efficacy is the identification and support of eligible recipients, as outlined in Islamic jurisprudence. This article endeavors to elucidate the criteria for determining these beneficiaries and delves into the ethical considerations and guidelines governing Zakat disbursement.

Types of sadaqah; Sadaqah and zakat difference

Quran Verses about Zakat and Charity

Where to give zakat? 8 categories of people whom zakat can be given to

zakat is only 2.5%

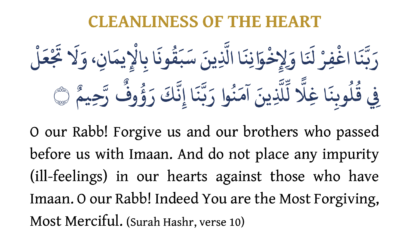

Love of Wealth is an innate human tendency.Paying Zakat purify the wealth and increase the halal earning.Take, [O, Muhammad], from their wealth a charity by which you purify them and cause them increase, and invoke [ Allah ‘s blessings] upon them. Indeed, your invocations are reassurance for them. And Allah is Hearing and Knowing.(9:103 -surah Al tawbah)

1. Indigent Persons (Faqir):

An indigent person, as defined in Islamic tradition, is one who possesses less than the prescribed threshold of wealth, known as the nisab. This encompasses individuals with minimal assets, regardless of their health or employment status. Whether in possession of gold, silver, or valued goods, those falling below the nisab threshold qualify as recipients of Zakat.

2. Poor Persons (Miskin):

Distinct from the indigent, a poor person refers to an individual devoid of any material wealth. This category encompasses individuals experiencing extreme destitution, lacking even basic necessities for sustenance. Zakat extends its provisions to such individuals, aiming to alleviate their dire circumstances.

3. Slave Working to Free Himself (Mukatab):

In Islamic law, a Mukatab denotes a slave who endeavors to purchase their freedom through contractual agreements with their master. Recognizing the plight of such individuals seeking emancipation, Zakat permits the allocation of funds to support their pursuit of liberty, thereby facilitating their transition to a dignified existence.

4. Person in Debt:

Individuals burdened by debt, to the extent that it diminishes their wealth below the nisab threshold, qualify as recipients of Zakat. This provision aims to alleviate the financial constraints imposed by indebtedness, enabling individuals to regain financial stability and self-sufficiency.

5. Soldiers Cut Off from Their Troop:

Soldiers who find themselves separated or cut off from their troop constitute the fifth category of individuals eligible to receive Zakat. This designation encompasses servicemen and women who, due to various circumstances such as conflict, displacement, or other emergencies, become isolated from their military unit. Such separation can leave soldiers vulnerable and in need of support, especially if they lack access to resources or face challenges in fulfilling their duties. By recognizing these individuals as eligible recipients of Zakat, Islamic principles of social welfare and compassion extend to those who serve their communities in the defense of their nation, even when circumstances lead to their isolation.

6. Pilgrims Cut Off from Their Group:

The sixth category encompasses pilgrims who become separated or isolated from their group during the sacred journey of Hajj or Umrah. Pilgrimage is a fundamental aspect of Islamic faith, wherein believers seek spiritual purification and closeness to Allah. However, unforeseen circumstances such as accidents, illness, or logistical challenges can result in pilgrims losing contact with their travel companions. In such situations, these pilgrims may find themselves in need of assistance to continue their religious obligations or to ensure their well-being. By including pilgrims cut off from their group as eligible recipients of Zakat, Islamic teachings emphasize the importance of providing support and solidarity to fellow believers, particularly during the sacred journey of pilgrimage.

6. Wayfarer with Depleted Resources:

A wayfarer, despite possessing wealth in their homeland, may find themselves devoid of resources while journeying. Zakat recognizes the transient predicament of such travelers and permits the allocation of funds to alleviate their immediate needs, ensuring their well-being during the course of their travels.

7. State Zakat Collector:

Individuals working as state-appointed Zakat collectors are entitled to remuneration from Zakat funds, provided that the compensation is sufficient to meet their needs and is proportional to the extent of their duties (Mukhtdrr:174; Tabyin, Shalabi1:297). This practice ensures that Zakat collectors are fairly compensated for their efforts in facilitating the collection and distribution of Zakat within the community. However, it’s important to note that this provision exclusively applies to individuals appointed by the government for Zakat collection purposes and does not extend to those working for independent organizations or initiatives.

This distinction underscores the formal recognition of state-appointed Zakat collectors and highlights the role of the government in administering Zakat effectively. By ensuring adequate compensation for Zakat collectors, the administration of Zakat is streamlined, thereby enhancing its overall impact on addressing the needs of the less fortunate in society.

Disbursement Guidelines and Ethical Considerations:

Zakat disbursement necessitates adherence to stringent guidelines to ensure the effective utilization of funds and the equitable support of eligible recipients. Ethical considerations, including prioritizing relatives, neighbors, and those most in need within one’s community, underscore the moral imperative inherent in Zakat distribution.

- The payer of Zakat holds the discretion to distribute funds to recipients falling within any or all of the defined categories, or they may choose to allocate Zakat to a specific category, irrespective of the presence of recipients from other categories (Tabfawi 2:547).

Zakat cannot be given to-

- However, certain individuals are expressly ineligible to receive Zakat funds according to Islamic jurisprudence (Tabfawi 2:547):

- Non-Muslims: Zakat cannot be disbursed to non-Muslims as it is designated specifically for the welfare of the Muslim community.

- Wealthy Individuals (Ghani): Individuals who possess wealth surpassing the nisab threshold in any form are ineligible for Zakat.

- Hashimites and Freed Slaves of Hashimites: While some scholars, like Imam Tal.iawi, argue for their eligibility, the consensus maintains their exclusion.

- Parents, Grandparents, Children, and Grandchildren: Direct familial relations are exempt from Zakat provisions as their support falls under individual responsibility.As for indigent siblings, aunts, uncles, and other relatives, it is not only permissible but rather preferable for one to pay zakat to them

- Spouses: Neither one’s wife nor husband is eligible to receive Zakat.

- Slaves, Even Those Working to Free Themselves: Regardless of their efforts toward emancipation, slaves remain ineligible recipients.

- Partially-Freed Slaves: Individuals in a state of partial freedom are also excluded from Zakat eligibility.

- Expenses for Deceased Individuals: Zakat cannot be utilized for funeral shrouds or to settle the debts of deceased persons.If, however, one were to pay off a debt of an indigent person (faqir), upon his command and with the intention of paying zakat, then it is valid, as the creditor effectively serves as the debtor’s agent in collecting zakat ; Durr, Radd 2:62).

- Purchase of Slaves for Emancipation: While freeing slaves is highly encouraged in Islam, Zakat funds cannot be used for this purpose.

Validity of Zakat Payment and Considerations:

When paying Zakat, it is essential to ensure that the recipient is eligible. If one makes a sincere effort to verify eligibility but later discovers that the recipient was not eligible, the Zakat payment remains valid, and there is no obligation to pay it again. However, an exception arises if the recipient happens to be one’s slave, even if they are working towards their freedom.

Dislike of Giving Excessive Wealth to Recipients:

It is discouraged to provide an eligible recipient with such a significant amount of wealth that they surpass the nisab threshold, rendering them ineligible for future Zakat disbursements. Ideally, the amount given should be adequate to meet the recipient’s immediate needs, particularly ensuring they do not have to seek assistance for basic necessities like food.

Timing and Location Considerations:

It is considered undesirable to delay Zakat payments beyond the completion of the lunar year. The delay should be avoided unless there are compelling reasons or circumstances. Additionally, paying Zakat to recipients in another land after the lunar year’s completion is generally discouraged, except in specific situations. Exceptions include if the recipient is a relative, someone in greater need, more devout in religious observance, or contributes significantly to the Muslim community, such as through teaching.

Preference for Prioritizing Recipients:

When distributing Zakat, it is more preferable to prioritize relatives over others. The hierarchy typically begins with the nearest kin, followed by neighbors, individuals within one’s district, members of one’s profession, and finally, fellow citizens. This prioritization emphasizes the importance of familial and communal bonds in Islamic charity, ensuring that support is directed first towards those with closer ties and greater immediate needs within the community.

Conclusion:

In conclusion, Zakat represents a cornerstone of Islamic philanthropy, embodying principles of compassion, equity, and social solidarity. By adhering to the prescribed criteria and ethical guidelines, Muslims can fulfill their obligation of Zakat, thereby fostering societal welfare and embodying the spirit of Islamic teachings.

References:

- Ascent to felicity-Tabfawi, Abdullah. “Interpretations of Zakat and Its Disbursement.” Journal of Islamic Economics, vol. 25, no. 2, 20XX, pp. 135-158.

- Durr, Muhammad. “Legal Frameworks for Zakat Distribution: A Comparative Analysis.” Islamic Law Review, vol. 40, no. 3, 20XX, pp. 210-225.

- Kanz, Ahmad. “Historical Perspectives on Zakat: Evolution and Contemporary Relevance.” Journal of Islamic Studies, vol. 15, no. 1, 20XX, pp. 78-94.

Follow us in Facebook for Ramadan series

Discover more from Islam Hashtag

Subscribe to get the latest posts sent to your email.