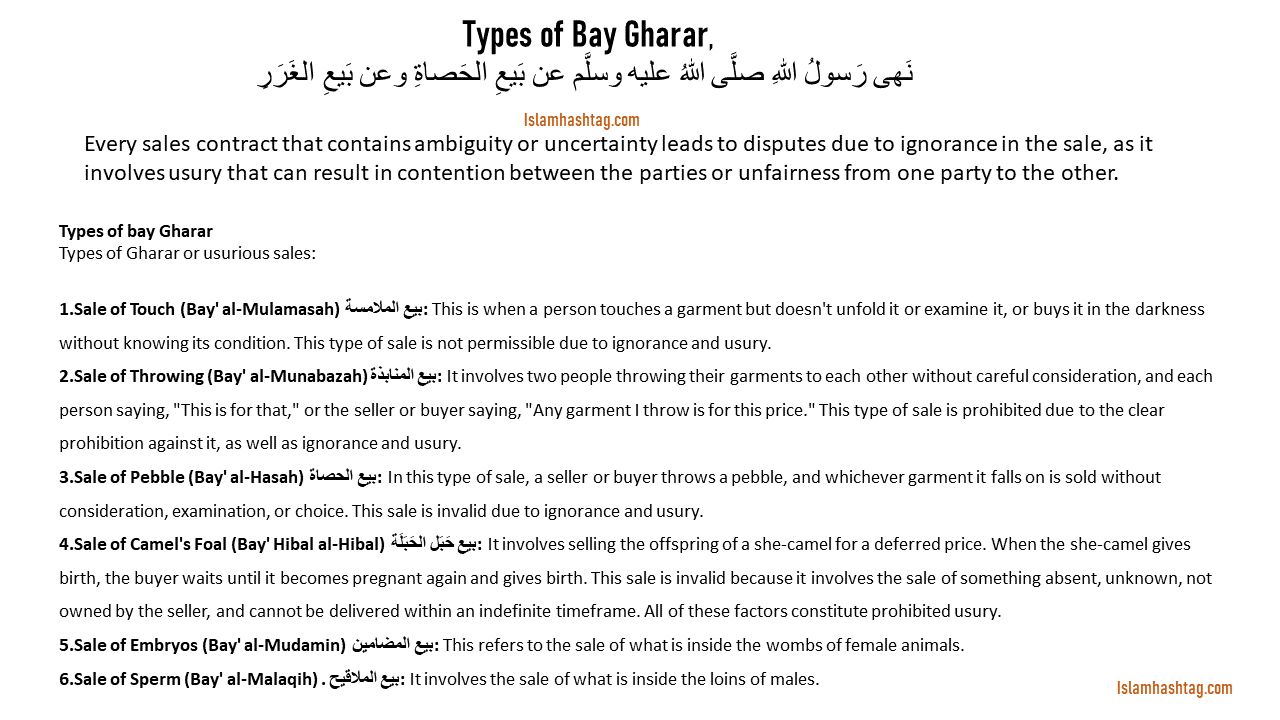

Types of Bay Gharar in Islamic Finance

Gharar is an Arabic term that refers to uncertainty, ambiguity, hazard, and risk in a contract or transaction. It signifies the presence of excessive uncertainty or ambiguity that can lead to disputes or exploitation of one party by another.

Key Aspects of Gharar in Buyu

- Excessive Uncertainty: Gharar arises when a contract contains an unacceptable level of uncertainty. This uncertainty can be related to the subject matter, price, or other essential terms of the contract. Contracts that rely on future events that are unpredictable or contingent upon uncertain factors may be considered Gharar.

- Ambiguity in Terms: Ambiguity in contract terms is another aspect of Gharar. When the language of a contract is vague or open to multiple interpretations, it can lead to disputes and conflicts between parties. Islamic commerce emphasizes the importance of clear and unambiguous terms in Buyu.

- Hidden Defects: Gharar can also result from hidden defects or undisclosed information about the goods or services being exchanged. If one party conceals information that is essential for the other party to make an informed decision, it creates Gharar in the transaction.

- Prohibition of Excessive Risk: Islamic commerce discourages transactions that involve excessive risk. While all business transactions inherently carry some degree of risk, Gharar occurs when the risk is deemed unreasonably high or when one party is unfairly exposed to potential losses.

What is Bay Gharar?

كل عقد للبيع فيه ثغرة للتنازع، بسبب جهالة في المبيع لأنه غرر يؤدي إلى الخصومة بين الطرفين، أو غبن أحدهما الأخر

Every sales contract that contains ambiguity or uncertainty leads to disputes due to ignorance in the sale, as it involves usury that can result in contention between the parties or unfairness from one party to the other.

Ibn Taymiyyah said: The corruption of bay gharar lies in fostering enmity, hatred, and consuming wealth unjustly. It is also a form of risk, gambling, and easy gain that Allah has forbidden in the Quran.

Al-Nawawi said: The prohibition of usurious sales is a significant principle in the laws of commercial transactions, and it includes issues such as selling a slave who intends to become free, selling the unknown and the absent, selling what cannot be delivered, and selling what the seller does not have full ownership of, like selling fish in water, milk in the udder, a fetus in the womb, and all of these are invalid because they involve usury[3].

نَهى رَسولُ اللهِ صلَّى اللهُ عليه وسلَّم عن بَيعِ الحَصاةِ وعن بَيعِ الغَرَرِ

Types of bay Gharar

Types of Gharar or usurious sales:

- Sale of Touch (Bay’ al-Mulamasah) بيع الملامسة : This is when a person touches a garment but doesn’t unfold it or examine it, or buys it in the darkness without knowing its condition. This type of sale is not permissible due to ignorance and usury.

- Sale of Throwing (Bay’ al-Munabazah) بيع المنابذة: It involves two people throwing their garments to each other without careful consideration, and each person saying, “This is for that,” or the seller or buyer saying, “Any garment I throw is for this price.” This type of sale is prohibited due to the clear prohibition against it, as well as ignorance and usury.

- Sale of Pebble (Bay’ al-Hasah) بيع الحصاة : In this type of sale, a seller or buyer throws a pebble, and whichever garment it falls on is sold without consideration, examination, or choice. This sale is invalid due to ignorance and usury.

- Sale of Camel’s Foal (Bay’ Habal al-Habal) بيع حَبَل الحَبَلَة : It involves selling the offspring of a she-camel for a deferred price. When the she-camel gives birth, the buyer waits until it becomes pregnant again and gives birth. This sale is invalid because it involves the sale of something absent, unknown, not owned by the seller, and cannot be delivered within an indefinite timeframe. All of these factors constitute prohibited usury.

- Sale of Embryos (Bay’ al-Mudamin) بيع المضامين : This refers to the sale of what is inside the wombs of female animals.

- Sale of Sperm (Bay’ al-Malaqih) .بيع الملاقيح : It involves the sale of what is inside the loins of males.

Sales of embryos and sperm are invalid due to being based on the sale of something absent, unknown, and involving usury. Additionally, they cannot be delivered.

You can share this image of Types of Bay Gharar or add it to your notes. You can read more about in Kitab Buyu Tashreeh or Mukhtasar al Quduri.

Contemporary Examples of Usurious Sales:

- Lottery tickets

- Phone-in competitions

Follow us in Facebook

Discover more from Islam Hashtag

Subscribe to get the latest posts sent to your email.