Why is Interest Haram in Islam?

Interest (Riba) is considered haram (forbidden) in Islam, as it goes against the fundamental principles of fairness, justice, and social welfare that are deeply ingrained in the Islamic economic system.

Ramadan Offer

The Definition of Interest (Riba)

Interest, or Riba, is defined as the predetermined excess payment received by a lender over and above the principal amount of a loan, without any due consideration. In Islamic finance, Riba is categorized into two types: Riba al-Nasi’ah and Riba al-Fadl. Riba al-Nasi’ah refers to the increase in the principal amount of a loan due to the passage of time, while Riba al-Fadl refers to the excess received by a lender in a transaction involving the exchange of goods of the same type but of different qualities.

What is Riba and the two types of Riba?

The Prohibition of Riba in the Qur’an and Sunnah

The prohibition of Riba is established in the primary sources of Islamic law, the Qur’an and the Sunnah (traditions and practices of the Prophet Muhammad). The Qur’an explicitly condemns Riba in several verses (Al-Baqarah: 275-281), warning against its severe consequences both in this world and the hereafter.

In the Sunnah, numerous Hadiths (sayings of the Prophet) emphasize the prohibition of Riba and the dangers it poses to individuals and society.

Reasons for the Prohibition of Interest in Islam

- Exploitation and Injustice: One of the primary reasons for the prohibition of Riba in Islam is that it leads to the exploitation of the poor and needy by the rich and powerful. Lenders who charge interest on loans often take advantage of the vulnerable financial situation of borrowers, leading to the accumulation of wealth in the hands of a few and perpetuating social and economic injustice.

- Discouraging Unproductive Activities: Interest-based transactions discourage productive economic activities, as they incentivize lending money for interest income rather than investing in potentially profitable ventures. Islam encourages trade, investment, and entrepreneurship, which contribute to economic growth and development.

- Promoting Risk-Sharing: The Islamic economic system promotes risk-sharing between parties involved in a financial transaction. In a profit-sharing arrangement, both the investor and entrepreneur share the profits and losses of a business venture. This stands in contrast to interest-based transactions, where the lender has a guaranteed return, and the borrower bears all the risk of loss.

- Ensuring Social Welfare: The prohibition of interest encourages Muslims to engage in charitable activities and provide interest-free loans (Qard Hasan) to those in need. This promotes social solidarity and reduces wealth inequality, ensuring the welfare of all members of society.

- Preserving Human Dignity: Charging interest on loans can lead to a never-ending cycle of debt, causing extreme hardship and humiliation for the borrower. By prohibiting Riba, Islam seeks to preserve the dignity of human beings and promote mutual respect and compassion in financial transactions.

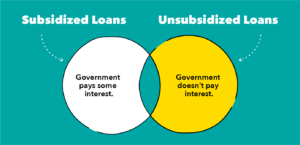

Difference between non-interest business transactions and interest-bearing transactions

The essential difference between non-interest business transactions and interest-bearing transactions rests on the following grounds:

(1) In ordinary business transactions there occurs a mutually equitable exchange of benefits between the buyer and the seller. The buyer derives benefit from the article which he purchases from the seller; the seller receives compensation for the effort, ingenuity and time spent on making the article available to the buyer. In interest-bearing transactions, on the other hand, the exchange of benefits does not take place equitably.

The interest receiving party, receives a fixed amount as a payment for using the loan he advances and thus his gain is secured. The other party to the transaction has only one thing at his disposal – a period of time during which he can make use of the funds loaned, and which may not always yield a profit. If such a person spends the borrowed funds on consumption, there is obviously no question of profit.

Even if the funds are invested in trade, agriculture or industry, one stands the chance both of making a profit and of incurring a loss during the period of time in question. Hence an interest-bearing transaction entails either a loss on one side and a profit on the other, or an assured and fixed profit on one side and an uncertain and unspecified profit on the other.

(2) In business enterprises the profit that a person makes, however large it may be, is made only once. The person who lends out money on interest receives, on the contrary, an on-going profit which multiplies with the passage of time. Moreover, however large the extent of the profit made by the borrower from the loaned money it will still be within certain limits, while the claims of the lender in return for this profit are unlimited.

It is even possible that the lender may seize the entire turnover of the borrower if he defaults on payment, thus depriving him of all the resources from which he makes his living. It is also possible that even after the lender has seized all the property of the borrower, his claims will still remain unsatisfied.

(3) In a business deal, the transaction ends with the exchange between a commodity and its price. After this exchange has taken place, no obligation remains on either party towards the other. If the transaction is that of rent, the thing rented (e.g. land or building) is not consumed but is rather used and remains intact, and is returned to the owner after a stipulated period of time. In a transaction involving interest, however, what actually happens is that the borrower first spends the loaned funds, then reclaims them with his efforts, returning them to the lender together with a surplus.

(4) In agriculture and industry, and in trade and commerce, one makes a profit after having expended one’s effort, intelligence and time. In an interest-bearing transaction, on the contrary, one becomes entitled to a sizeable share in the earnings of others without any toil and effort, by merely allowing someone to make use of one’s surplus money. The lender is neither a ‘partner’ in the technical sense of the term, for he does not share both the profit and the loss, nor is his share in proportion to the actual profit.

There is thus a tremendous difference from an economic point of view between business transactions as such and interest- bearing transactions. Whereas the former plays a highly constructive role in human society, the latter leads to its corrosion. This is in addition to its moral implications. By its very nature interest breeds meanness, selfishness, apathy and cruelty towards others. It leads to the worship of money and destroys fellow-feeling and a spirit of altruistic co-operation between man and man. Thus it is ruinous for mankind from both an economic and a moral viewpoint.

Discover more from Islam Hashtag

Subscribe to get the latest posts sent to your email.