Is subsidized student loan permissible

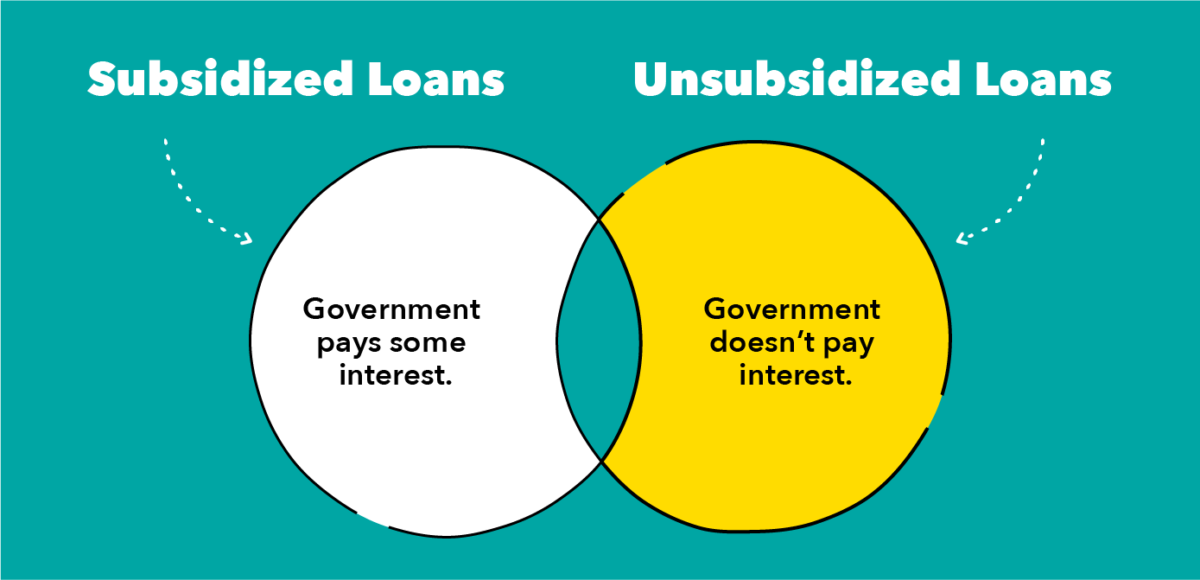

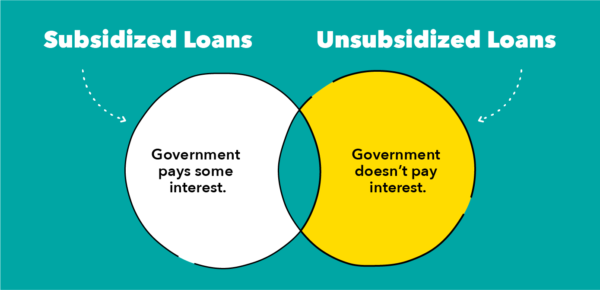

When applying for financial aid, the government offer grants and loans. There’s two types of loans: subsidized and unsubsidized. Subsidized means the student receiving the loan won’t have to pay the interest on the loan. There is still interest but the government is paying it under certain conditions.So is it permitted to take subsidized loan?

Let us understand the Direct and undirect subsidizied loan available.

According to the website.

Quick Overview of Direct Subsidized Loans

Who can get Direct Subsidized Loans?: Direct Subsidized Loans are available to undergraduate students with financial need.

How much can you borrow? Your school determines the amount you can borrow, and the amount may not exceed your financial need.

About Islamic car finance and halal Car Loan

Who will pay the interest?

The U.S. Department of Education pays the interest on a Direct Subsidized Loan

- while you’re in school at least half-time,

- for the first six months after you leave school (referred to as a grace period*), and

- during a period of deferment (a postponement of loan payments).

Quick Overview of Direct Unsubsidized Loans

Who can get Direct Unsubsidized Loans? Direct Unsubsidized Loans are available to undergraduate and graduate students; there is no requirement to demonstrate financial need.

How much can you borrow? Your school determines the amount you can borrow based on your cost of attendance and other financial aid you receive.

Who will pay the interest?

You are responsible for paying the interest on a Direct Unsubsidized Loan during all periods.

Riba, Why is Interest Haram in Islam?

Is it permitted to take subsidized loan?

According to a fatwa,

In principle, interest bearing loans are not permissible. This includes interest bearing student loans. The prohibition of this is generally extended to people of all financial conditions.

The usubsidized student loans in question are not permissible as the debtor will be paying interest on it.

As for the subsidized student loans, there are two issues: interest and loan fee. We understand that the government pays the interest. While this would not generally make a difference in the prohibition, the government is the creditor in the enquired situation. Thus, the government is paying itself the interest. This is not riba in reality. As far as the loan fee is concerned, we understand that this amount is deducted before the creditor receives it. In reality, the debtor receives a loan of a lesser amount than stated and he pays only the received amount back. Accordingly, the subsidized student loan in question is permissible.

Follow us in Facebook

Discover more from Islam Hashtag

Subscribe to get the latest posts sent to your email.