Book on Islamic Finance: In my view, the first book you must read when you want to understand the Islamic finance is an Introduction to Islamic Finance by Mufti Taqi Usmani

Do you know what is Islamic Fintech? Read this detailed article on Islamic Fintech

Also read : What is Riba and types of Riba

An Introduction to Islamic Finance(amazon)

Book on Islamic Finance by Mufti Taqi Usmani(pdf)

This book is recommended in Darul uloom and it is a clear explanation of different types of finance by Mufti Taqi Usmani. He was once on Dow Jones Islamic Market™ Index Shari’ah Supervisory Board. Currently he is Chairman, International Shariah Standard Council, Accounting and Auditing Organization for Islamic Financial Institutions, Bahrain

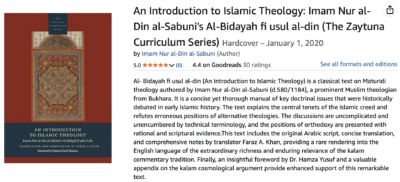

Below is an excerpt from the Forward of the book- An Introduction to Islamic Finance(amazon)

This will help us understand the importance of Islamic Finance in today’s time.

Over the last few decades, the Muslims have been trying to restructure their lives on the basis of Islamic principles. They strongly feel that the political and economic dominance of the West, during past centuries, has deprived them of the divine guidance, especially in the socio-economic fields. Therefore, after acquiring political freedom, the masses are striving for the revival of their Islamic identity to organise their collective life in accordance with the Islamic teachings.

In the economic field, it was the biggest challenge for such Muslims to reform their financial institutions to bring them in harmony with the dictates of Shari’ah. In an environment where the entire financial system was based on interest, it was a formidable task to structure the financial institutions on an interest free basis.

The people not conversant with the principles of Shari’ah and its economic philosophy sometimes believe that abolishing interest from the banks and financial institutions would make them charitable, rather than commercial, concerns which offer financial services without a return. Obviously, this is totally a wrong assumption. According to Shari’ah, interest free loans are meant for cooperative and charitable

activities, and not normally for commercial transactions, except in a very limited range. So far as commercial financing is concerned, the Islamic Shari’ah has a different set-up for that purpose.

The principle is that the person extending money to another person must decide whether he wishes to help the opposite party or he wants to share his profits. If he wants to help the borrower, he must rescind from any claim to any additional amount. His principal will be secured and guaranteed, but no return over and above the principal amount is legitimate. But if he is advancing money to share the profits earned by the other party, he can claim a stipulated proportion of profit actually earned by him, and must share his loss also, if he suffers a loss.

It is thus obvious that exclusion of interest from financial activities does not necessarily mean that the financier cannot earn a profit. If financing is meant for a commercial purpose, it can be based on the concept of profit and loss sharing, for which musharakah and mudarabah have been designed since the very inception of the Islamic commercial law.

There are, however, some sectors where financing on the basis of musharakah or mudarabah is not workable or feasible for one reason or another. For such sectors the contemporary scholars have

suggested some other instruments which can be used for the purpose of financing, like murabahah, ijarah, salam or istisna.

Since last two decades, these modes of financing are being used by the Islamic banks and financial institutions. But all these instruments are not the substitutes of interest in the strict sense, and

it will be wrong to presume that they may be used exactly in the same fashion as interest is used. They have their own set of principles, philosophy and conditions without which it is not allowed in Shari’ah to use them as modes of financing. Therefore the ignorance of their basic concept and relevant details may lead to confusing the Islamic financing with the conventional system based on interest.

The book, Islamic Finance by Mufti Taqi Uthmani is a revised collection of my different articles that aimed at providing basic information about the principles and precepts of Islamic finance, with special reference to the modes of financing used by the Islamic banks and non-banking financial institutions. I have tried to explain the basic concept underlying these instruments, the necessary requirements for their acceptability from the Shari’ah standpoint, and the correct method of their application. I have also dealt with the practical issues involved in the application of these instruments and their possible solutions in the

light of Shari’ah.

A wonderful book very well written my Mufti Taqi sahab Masha Allah. I would definitely recommend this book.

Other books on Islamic Finance are :

1)Islamic Finance-Why It Makes Sense?

This is an interesting book on Islamic Banking by interesting authors:-Vicary Daud Abdullah &, Keon Chee Both the authors were not born in non- Muslim families.They obtained an excellent insight on how a person new to Islam or finance,or both can go about understanding Islamic finance.This book looks at the Islamic finance from the perspective of consumer who has to make very important decision throughout his/her life.The book’s cover and pages are all very appealing.

It covers the following topics:

- Why Islamic finance

- Basic Islamic finance principles

- Islamic contracts

- Building an Islamic finance framework

- How financial market works

- financing based on debts

- Financing based on leasing

- Trade financing ,etc

2)Introduction to Islamic Banking & Finance: Principles and Practice

This book Covers the essential elements of Islamic Banking and Finance, as well as the latest views on topical debates surrounding the discipline,This text is essential reading for anyone seeking to understand this increasingly important sector of the finance industry.It is particularly good for students and people who are new to Islamic Finance.

An Introduction to Islamic Banking and Finance contains following chapters:

- Chapter 2 Islamic Contract Law

- Chapter 3 Financial Instruments of Islamic Banking and Finance

- Chapter 4 Financial Accounting for Islamic Banking Products

- Chapter 5 Corporate Governance for Islamic Financial Institutions

- Chapter 6 Islamic Asset and Fund Management

- Chapter 7 Islamic Bonds

- Chapter 8 Islamic Insurance (Takaful)

- Chapter 9 Islamic Microfinance

- Chapter 10 Risk Management in Islamic Finance

3)Islamic Finance For Dummies

Islamic Finance For Dummies helps experienced investors and new entrants into Islamic finance quickly get up to speed on this growing financial sector.This book addresses the risks and rewards in Islamic banking and highlights the future prospects and opportunities of the Islamic finance industry. This book offers the fastest and easy way to tap into the booming Islamic finance arena.Again if you are new to Islamic finance,this book is for you.

It covers the following topics:

- Basics of Islamic Finance

- Introducing Islamic Commercial laws

- Eyeing Islamic Banking operation

- Islamic Investment markets

- Issuing financial statements,managing risk

- Takaful: Islamic Insurance

4)Islamic Finance: Ethics, Concepts, Practice

If you are in search of a book that is cheap,and which covers all aspect of Islamic Finance, and Islamic banking,then this book is for you.It is written by Usman Hayat and Adeel Malik. In this book,we learn about interest free banking and how the context of Islamic finance is not confined to Islam.It highlights the regulatory issues and political economy of Islamic finance.A nice book with eight chapters covering all essential aspects of Islamic banking.

It covers the following topics:

- Islamic Economic thought

- Sharia and prohibitions shaping Islamic finance

- Islamic Finance in practice

- Regulatory issues

- Governance and social responsibilities

- political economy of Islamic finance

- Elaborates on” form vs substance” debate

- summarises the finding of emperical studies while offering concluding thought

5)Introduction to Islamic Economics: Theory and Application (Wiley Finance)

A book by wiley finance,it is written specifically for finance and investment professionals as well as for sophisticated individual investors and their financial advisors. But it is not that difficult to understand.Although I am not a finance person,but I am particularily impressed by this book.Beside covering the fundamental of Islamic economics,it explains the foundation of Islamic economic,riba free banking,role of fiscal policy,role of monetary policy,risk sharing it goes further to the microeconomic and macroeconomic concept.Each chapter has a summery,a key word note and set of questions.A nice book to understand the practical application of Islamic finance.

It touches on the following aspects

What is Economic system?

- The difference between the economic system and the role the government plays

- How the ideal Islamic system differs from westerm markets capitalist system

- The role of markets and how do they differ in Islam and in the market capitalist system

- What institutions are and why they matter for islamic prosperity

- Public policy in the islamic economic system

- monetary policy,fiscal policy,Risk sharing. Takaful etc.

- It basically covers almost all aspects of Islamic finance.

And finally,

Also read : Books on Islamic banking

Discover more from Islam Hashtag

Subscribe to get the latest posts sent to your email.